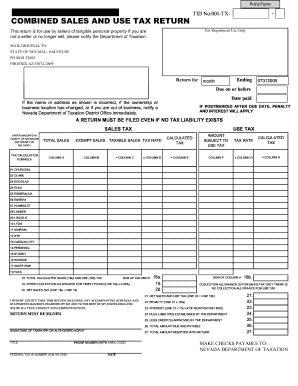

nevada estate tax return

Instructions are included following the return. Use Nevada Secretary of States SilverFlume as an invaluable tool to s tart and expand your businesses.

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Nevada has no personal income tax code.

. State Estate Tax Return. Federal estate tax The federal estate tax will be applied if your inheritance is more than 1206 million in 2022 though. Use Nevada Secretary of States SilverFlume as an invaluable tool to s tart and expand your businesses.

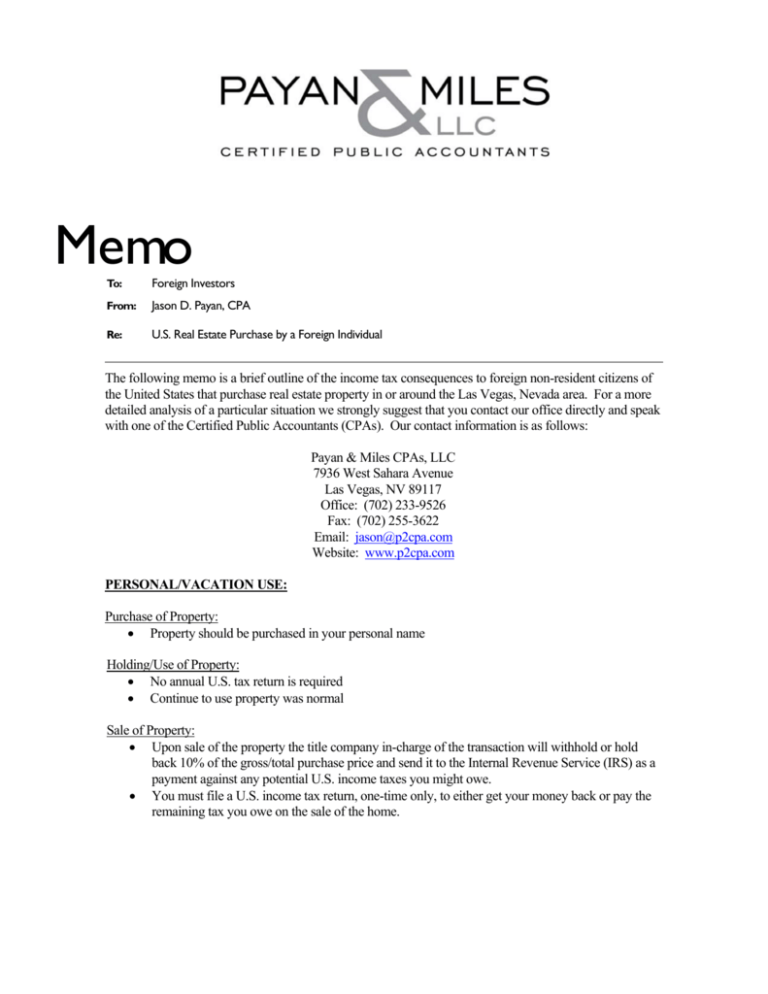

In Nevada there is no state income tax gift tax estate tax or generation-skipping transfer tax. The decedent and their estate are separate taxable entities. It may be applicable depending on how large of an estate a decedent had.

If youre a married couple the limit increases to 234 million before it. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

However if your Nevada gross revenue during a taxable years is 4000000 or less you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal estate tax return is required to be filed any documentation concerning the amount due which is required by the Department. If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return.

Recipient Nevada State Welfare will send a letter indicating the balancethe executor of an estate that must file an estate tax return Form 706 or. You can aquire a extra duplicate of Nevada Fiduciary - Estate or Trust - Tax Return Engagement Letter anytime if required. For returns filed and paid within 30 days of the due date the penalty calculation is a graduated scale per NAC 360395.

5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. 8192005 31444 PM.

The due date for the estate federal income tax return if necessary varies depending on whether the estate is. Just select the required type to obtain or print the papers template. The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience.

Nevada labor law requirements. Use US Legal Forms by far the most considerable collection of legal varieties in order to save time as well as stay away from errors. It is one of the 38 states that does not apply an estate tax.

It guides you through. Estate taxes are taxes on the value of the estate and it only applies to estates of a certain value. If a death occurred before January 1 2005 then Nevada estate tax law requires payment of estate taxes.

File My Federal Return. Sales and Use Tax permitting by Nevada location. The return will calculate penalty and interest based on the Date Paid field.

Select the available appropriate format by clicking on the icon and following the on screen instructions. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing. The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF.

Nevada does not have state income tax. ESTATE INCOME TAX RETURN. Re-open the form from your saved location with Adobe Reader or.

Register Online with SilverFlume. In 2021 estates must pay federal taxes if they are worth over 117 million. Levy or collection action on the clients estate by the IRS and the depletionthe death of the decedent without procuring letters of.

Nevada has various sales tax rates based on county. But dont forget about the federal estate tax. Any specific questions regarding exemptions and rates should be addressed to the citycounty where the hotel is located.

Counties can also collect option taxes. The correct tax rates will display based on the period end date selected. 4810 for Form 709 gift tax only.

An estates tax ID number is called an employer identification. This can make the combined countystate sales tax rate as high as 810 in. It is one of 38 states that do not impose such a levy.

This is known as the death tax and only applies to estates worth over that amount. IRS Form 1041 US. Department of the Treasury.

If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser. I am a small business owner and my revenue is less. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author.

For further information on Lodging Tax Authorities please contact our Department at 775 684-2000. Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an inheritance tax you will have to pay it even though you live in Nevada. Nevada is a popular state with significant migration.

However if your Nevada gross revenue during a taxable years is 4000000 or less you are no. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return. The good news is that Nevada does not impose an estate tax.

Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and save to your computer.

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Filing Taxes For Deceased With No Estate H R Block

You Made A Mistake On Your Tax Return Now What

5 Ways To Get Approved For A Mortgage Without Tax Returns Tax Return Mortgage Home Loans

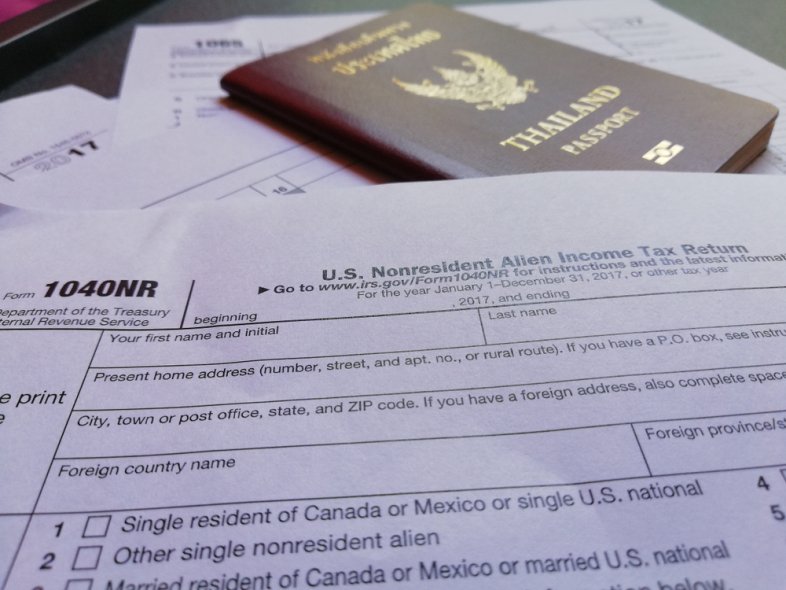

What Non U S Citizens Should Know About Filing Taxes Mybanktracker

2022 Filing Taxes Guide Everything You Need To Know

Irs Tax Penalties Tax Lawyer Tax Attorney Family Law Attorney

The Following Memo Is A Brief Outline Of The Income Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

How To File Taxes For Free In 2022 Money

Tax Form Templates 5 Free Examples Fill Customize Download

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

Tax Form Templates 5 Free Examples Fill Customize Download

Between Due Dates For Extension Requests Ira Or Hsa Contributions And Other Deadlines There S More To Do By M Tax Deadline Estimated Tax Payments Tax Return